After attending the SKIFT 2019 Short Term Rental Summit, I figured I would share my notes from the Confrence. This is in no way complete of everything covered and is only the Highlights.

As the conference started off Wouter Geertsthe senior research analyst for Skift discussed the Short Term Rental ecosystem.

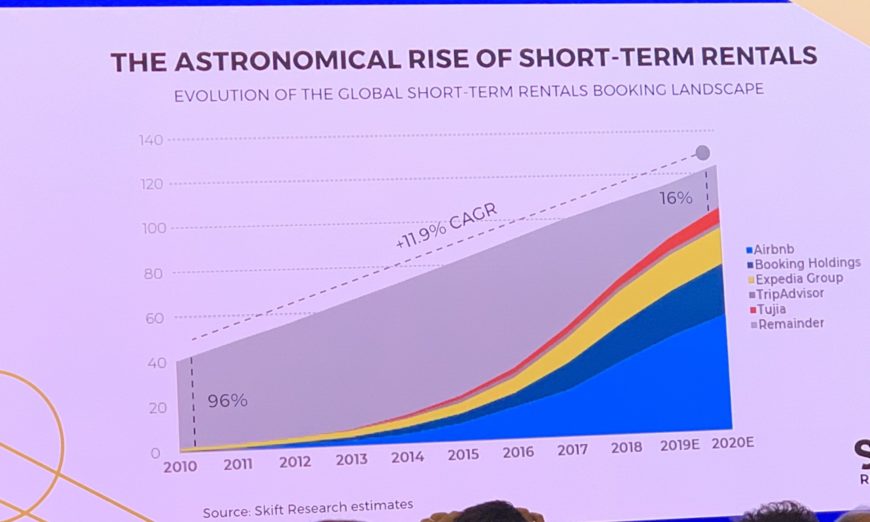

Mr Geertshe discussed how the industry has grown an average of 11.9 year over year “CAGR”. He also said that the main 5 booking companies now account for 85% of all bookings for the industry.

Francis Davis the CEO of Sonder discussed his company and strategy

According to the presentation Sonder raised 360 million dollars has 3500 units and 10000 more in the pipeline Francis says they sell experiences not tech but tech is important to their overall strategy

Francis is looking to shorten payback periods for Sonder’s lease deals. “The magic” according to Francis, is the global supply chain tech to enable the rapidly and efficiently furnish arbitraged properties with minimal capital. That wouldn’t be possible without their tech stack. Francis believes that his in-house tech is his competitive advantage. Building tech to streamline operational efficiencies is the focus of his tech initiatives

Markets with supply/ demand mismatch is creating opportunity for him in his ability to provide. 73 percent of new inventory last quarter they have taken is contracts that take the entire building they occupy. He says 20 to 30 percent lift to his developers. Sonder currently has 26 hotels and more that are apartment hotels. They are currently negotiating with 70 hotels for management under their new business model

Has the ambition of being an “iconic” brand that is one stop in all categories. He stated that his goal is to be the next generation Marriot or Hilton. As he plans to execute his and “re-think the industry.”

When questions about the next pull back he says if he is not careful it can be a problem but the strategy works around a risk management portfolio.A statement I found interesting is Mr. Davis’s disclosure to the audience that his contracts have a rent pullback in case of recession. He reiterated that risk management must be a core competency of his business.

Sonders, according to Francis has about 30% direct bookings and is currently his fastest growing channel. Mergers and Acquisition is possible while growing aggressively through Europe but currently no acquisitions have been done to date. Their hotels are real hotels with 350 sq ft rooms (not vacation rental hotels) they use their technology to radically lower the operating cost and guarantee better ROÍ for the hotel owner. In my opinion it sounded like they plan to run hotels more like a self-checked in vacation rental to lower fees. However he didn’t explicitly say that.

Jennifer Hsiesh the VP of Homes and Villas Marriott was Interviewed by Nancy Trejos. According to Ms. Hsiesh the Marriot choose to get into the market because more than 27 percent of their customer base was leaving for vacation rentals. They are not getting into the management business but are acting as a booking platform with quality standards and assurances for their loyalty members.

The intention of Marriott’s model is to provide reassurance to guests because with all the choices and variance of quality and service levels in the market they believe it’s causing stress and anxiety for renters. They are looking to provide a solution to that problem.

When choosing a property manager to work with their process Jennifer shared three layers or steps they are currently using.

- How does the property manager look from service, financials and legal compliance

- They look at every home to decide what is a Marriott approved home

- Quality assurance ongoing to ensure the property is important.

For their guests, IF they feel a property is falling short of their expectations they will take the property off the inventory. Marriott has 137 million loyalty members that are part of their Bonvoy loyalty program. The expansion of offering Homes and villas are a way to keep them in their portfolio. The example was giving of some of their members may stay 100 to 150 nights a year in Marriott properties for business and would possibly like to spend their loyalty points on a Vacation home to spend time with family. Another example is that some executives or contractors may be placed in a city for extended time and a home may be a better offering by Marriott for some of those kind of stays.

Ms. Hsiesh explained that the backbone for of hotels and homes is housekeeping. They are partnered with Ecolab to help their business partners perform better. I personally thought that was amazing and would love to get Marriott training for my own training program at Casago University.

They have about 5000 homes so far. They see themselves as a partner and a selective channel partner in curating properties to offer through professional property managers.

Growing into this industry allows them to grow into markets where seasonality doesn’t make sense for traditional hotels. It allows them to be a global hospitality company in places they haven’t been before. Jennifer says that we will see more beach and ski destinations.

Jennifer again reiterated that compliance is important to them and is the only way they will continue to grow.

Next up was TJ CLARK from Turnkey and Jordan Allen of Stay Alfred took the stage next. Jordan said revenue management is the key to his success. If that goes down it’s code blue for his company. Stay Alfred has built their own tech and feels that they are building the same software and solutions but control is key reason why they continue with it.

TJ thinks that their tech program will eventually be sellable to homeowners.

According to TJ 20 % of his booking are direct. In contrast Jordan claimed 40% of all bookings for Stay Alfred was direct. That was the highest claim of an actually operator (non-booking platform) I heard at the conference and is an impressive claim. When considering properties for master lease they look at quality and proximity to primary market areas with in the city.

Jordan feels the regulatory is starting to smooth out. Short term rental impact on the character of the community and effect on affordable housing concerns.

Olivier Gremillon the VP OF GLOBAL SEGMENT BOOKING.COM Says that when the general population was surveyed year of year that more people year over year would rent their place.

They use booking.com to converge hotel and alternative lodging. They will use destination and occupants to select what to show. Olivier said that they had their first vacation home on booking.com in 2000. They currently have 6 million vacation rentals and private accommodations.

When asked if they are not seen as a millennial cool brand they said 50% of their bookings are direct and not search therefor they see themselves as a giant in the industry by volume but the bottom line that is generated is much greater.

Booking,com’s new quality listing score is their solution to have the same rating style as hotels. It seems to be good for the customers and customers so they will continue with this. They look at size and amenities based on location. It is a local basis for things such as AC would be strong in Miami but not Amsterdam.

ERIC MOORE VP PRODUCT VRBO

Eric started off saying Artificial Intelligence (AI) is on the way to the Short Term Industry. AI according to Eric is systems that can learn and improve based on large amounts of data. The larger the data set the better the decisions. For travel this can be used to solve the problems that guests are having for stays and for homeowners and managers to take guess work and anxiety out of travel

Eric discussed some of the collaborative tools that are using AI already in VRBO

Trip Boards is a shared wishlist that lets people collaborate and put plans and ideas in one place and make recommendations to homeowners.

VIRTUAL ASSISTANT OR CHAT BOT question that people are asking questions and using past questions as reference.

VRBO is using AI from expedia to improve its results and user experience. Eric says that the tech is young and will develop and get better more over time.

They do a lot of testing and about ⅔ of the time the test actually fails and has to be changed back. ⅓ of the time it helps push the reservations forward.

Eric claimed the variable rate of their booking fee is set by pricing and is not based on revenue management. They are seeing a larger return rate now with their app.

AirBnB was next to take the stage. What does success look like for AIRBNB? As of today they will promise to verify all their homes world wide with in a year.

If you have an open party you will be removed if it is on social media, if you’re in a multifamily property you’ll be removed but if you have a party with owner authorization they will allow parties. What I found interesting is that they will still allow parties if the owner allows it.

AirBnB is rolling out mayor hotlines for local city officials will be available next year. The goal is to have users have confidence that they will find what was advertised when they arrive. AIrBnB still uses the personal profile but doesn’t allow companies to market themselves

There were many more speakers but I missed some sessions and didn’t take notes on the others. Overall SKIFT 2019 had lots of high level players but very little in take away for property managers to go back with actionable data. One of the best exchanges was between Philip Minardi from Expeidia and the Brian Crawford from a hotel hotel lobbyist group AHLA. I have never met Philip Minardi before but he delivered a great performance and was well prepared to dismantle AHLA’s claims about the Vacation Rental Market. I was not taking notes so if you get a recap from someone else about the exchange you will be well served to understand how the hotel lobbyist are creating a lot of noise in the media about Vacation Rentals. Philip handled himself very professionally and even was applauded at times.

Also a shout out to Scott Shatford who did a great job but I just didn’t take good notes on.